Articles

Spring 2025

Against a much more challenging and uncertain economic outlook than at the time of the Autumn Budget, the OBR have halved their forecast for economic growth this year. Before accounting for proposed fiscal policy changes, much higher debt interest costs, with worsening sentiment and higher taxation, and significant risks arising from U.S. tariffs, probably leave a current budget with little or no headroom.

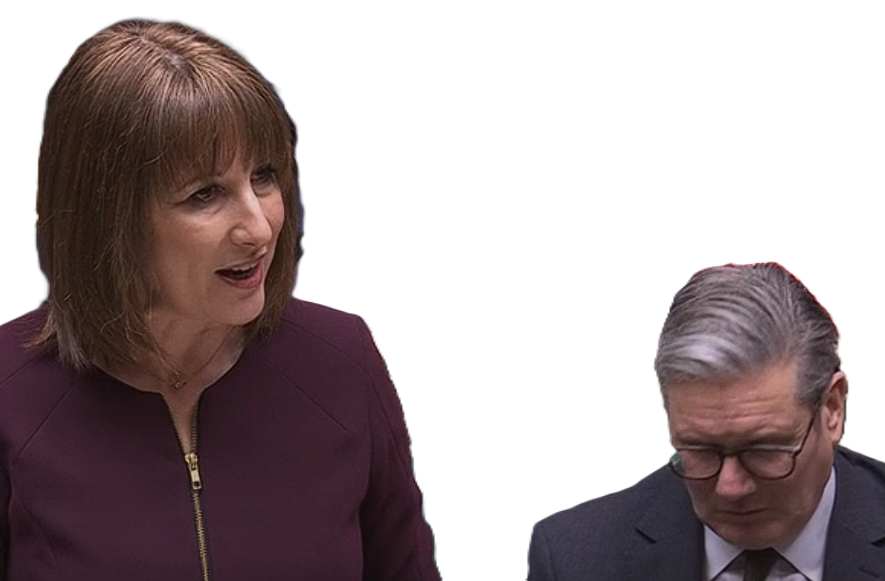

Autumn 2024

The first Labour Government Budget for 14 years increases public spending by around £70 billion annually, with two-thirds on current and one-third on capital spending. Just over half is funded through tax increases that will push the tax-take to a record 38 per cent of GDP. The remainder is funded by borrowing annually which the OBR say temporarily boosts GDP growth, but leaves UK economic output unchanged in the medium term.

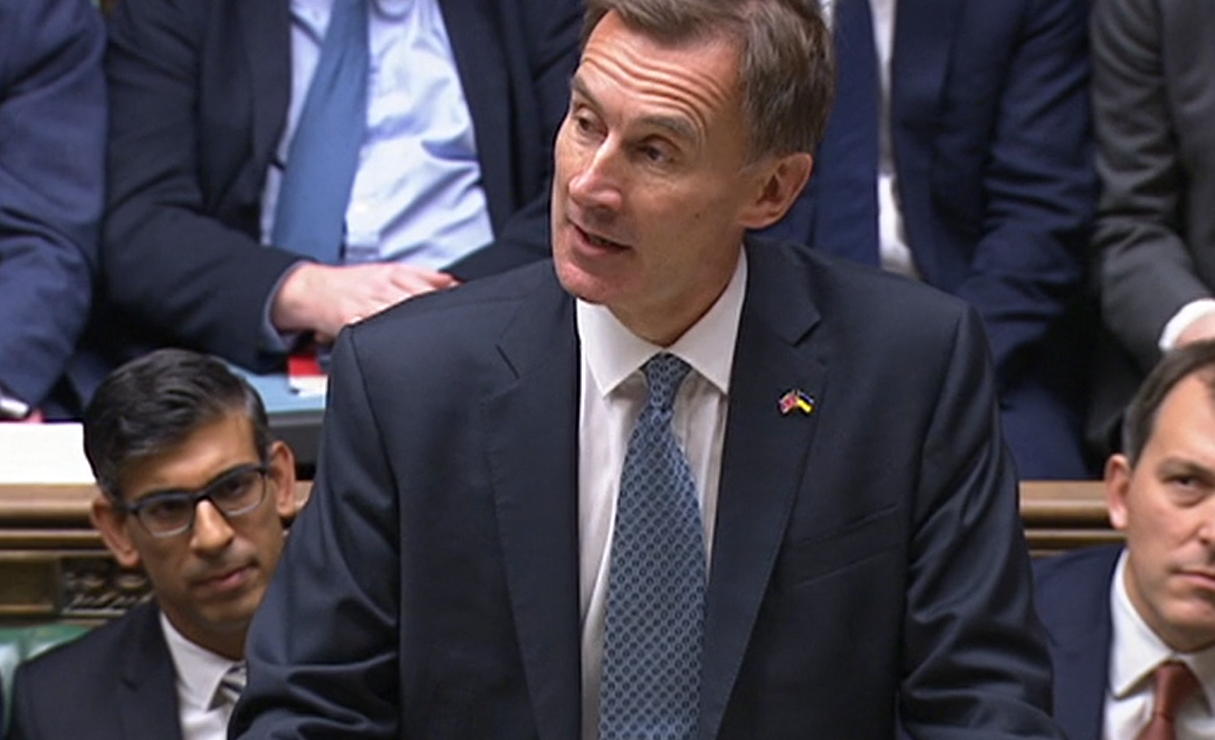

Autumn 2023

The UK economy has proved more resilient to the shocks of the pandemic and energy crisis. Even so, inflation has been more persistent and interest rates higher than expected. Higher inflation increases the Government's tax-take and the OBR have produced forecasts showing a rosier outlook for public finances, which the Chancellor took as the green light to reduce NICs' taxation, leaving debt falling by a narrow margin in five years.

Spring 2023

The OBR report that the economic and fiscal outlook has brightened since November 2022. In the comming year, the downturn is likely to be shallower. In his Spring Budget The Chancellor has spent two-thirds of the believed improvement in the Government's finances on support for energy costs, business investment and 'free childcare'.

Autumn 2022

Additional Government support over the next two years cushions the shock for consumers of the energy crisis – but the OBR predict the UK economy suffers a recession with living standards falling over the next two years. Underlying forecast changes of £55 billion on average for each year of the next five years , add to borrowing. Tax rises and (later) spending cuts offset much higher debt interest to have debt falling as a share of GDP.

Spring 2022

Two years to the day of the ‘national lockdown’ Chancellor, Rishi Sunak made a ‘Spring Statement’ to Parliament. The OBR say that public finances have emerged from the pandemic in better shape than expected. Yet existing inflationary pressures are exacerbated by Russia’s invasion of Ukraine. UK inflation will likely increase to a 40-year high. With around £30 billion of headroom against fiscal targets, the Chancellor eased back future tax increases.

Winter 2021

In March 2021, Rishi Sunak announced the highest tax increases since Norman Lamont’s Budget 28 years ago. The former Chancellor Lord Lamont warned that the current finance minister would be likely to have to increase taxes again if he wanted to attempt to balance day-to-day spending and revenue...