| Economic Outlook - Budget 2017 | |||||||||||||

|

|

On Wednesday 8 March 2017 the Chancellor Philip Hammond presented to Parliament the economic and fiscal forecast of the Office for Budget Responsibility (OBR) and apparently the very last spring Budget, intended to put an end to tax announcements being made twice a year. Will it work? Others have tried… Twenty years ago, the then Chancellor, Kenneth Clarke, inaugurated the “Unified Budget”. This was ditched in 1997 by Gordon Brown, with a budget in the spring and an autumn pre-budget report, which was then re-titled by George Osborne in 2010 as the Autumn Statement. Then between March 2015 and March 2016 there were four ‘fiscal events’!

UK Economic growth during the second half of 2016 continued unaffected by the EU referendum result for Brexit, although remaining dependent on increasing consumer spending, up by over 3% for the entire year, and the strongest annual expansion of consumer spending since 2004.

Even so total investment grew by only 0.5% in 2016, with business investment falling by 1.5%. Exports rose by 1.4%, but imports increased by 2.5%, the resultant net trade then reducing overall 2016 growth by half a percentage point (½%). Consumer-services industries (retail, restaurants and hotels) have all grown vigorously by between 5% and 6%, with service industries overall growing by nearly 3% in 2016. Manufacturing was weaker in comparison, growing by less than 1%. Construction saw a healthier 1.5% increase in output. From 2010 to 2015, London saw the fastest growth over this whole period, followed by the South East. The slowest rates of growth were in Northern Ireland, Yorkshire and the Humber. GDP growth has not slowed since the EU referendum The OBR’s changes to their economy forecast are relatively modest. This acknowledges the recent strength of the UK economy, largely through the dominance of consumer spending growing much more strongly than incomes through last year. The UK consumer’s confidence was undented by the Brexit vote, contrary to the expectation and predictions of many economists. The OBR now expects annual GDP growth to be higher in 2017, but lower in 2018 to 2020. The forecast from 2019 is virtually unchanged. After a strong start to the year, the OBR expect GDP growth to slow through 2017 as higher inflation (CPI: 2.3%) squeezes household budgets. They believe that the robust beginning should be sufficient to deliver 2% growth for 2017. Cumulative growth over the whole forecast period is little changed from last November’s five year economic and fiscal forecast. With real consumer spending growing at over 3% and the OBR estimating that the growth of household incomes is flat, the implication is that there has been a sharp fall in saving and increase in borrowing. The pace of which cannot continue indefinitely, the OBR have reasonably assumed.

Gross domestic product (GDP), the monetary value of all the finished goods and services produced, has had unbroken growth for 16 consecutive quarters (see above graph), the latest revised official statistics from the ONS show UK GDP growth over the last decade as:

The Purchasing Managers’ Index, an important indicator of output, was 54.5 last October and in February 2017 53.3, although signifying the index’s second successive monthly fall, it has now remained above the ‘magic 50’ level for six consecutive months, usually taken as a sign of increasing economic output.

The OBR see GDP growth slowing through much higher inflation caused chiefly by the fall of sterling, pressing on real incomes through higher import prices. In 2018, business investment is forecast to recover and that squeeze from higher inflation loosen. Lower sterling should then boost net trade and the UK economy through 2017 and into 2018. As of March 2017, the pound has fallen by 12% against a basket of the UK’s main trading partners’ currencies since the 23 June ‘16.

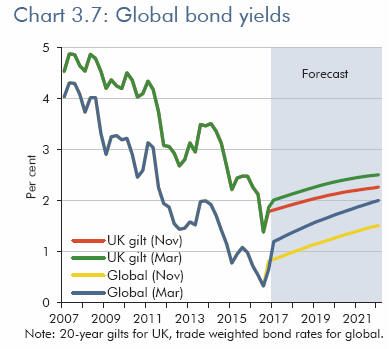

Central banks around the world cut interest rates sharply during the 2007-2009 financial crisis. Rates have stayed at historic lows since then, close to or below 0% in most developed economies. The Bank of England cut the Base Rate from 0.5% to 0.25% on 4 August 2016, the first change since March 2009. Expectations for Gilt rates (UK Government bonds) and global bond yields are both higher than at the time of the OBR's November forecast (see Chart 3.7). One factor driving these changes is market speculation over possible changes to US fiscal policy under the new Trump administration.

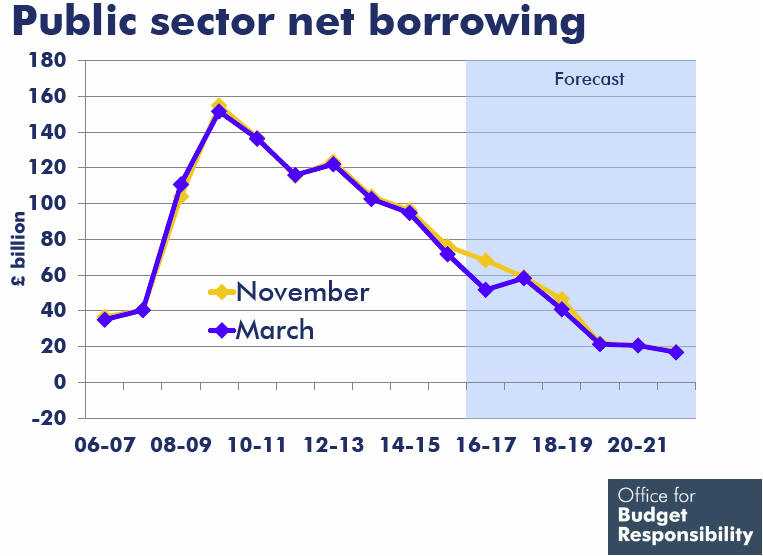

Public finances Although developments in the world and UK economy since November have had a relatively modest impact on the public finances, the OBR believe public sector net borrowing will be a lot lower this year than they had originally thought last November. Largely reflecting one-off factors and timing effects that flatter this year’s data, for example, accelerated tax receipts from income shifting to beat higher dividend taxation.

2016/17 public sector current receipts are projected at £721bn, less total managed expenditure of £773bn, the deficit is now forecast to come in at nearly £52 billion this year (2016/17) or 2.6% of GDP (cf. the peak, 2009-10: £152bn or 9.9% GDP).

Anthony Denny 22 March 2017 |

||||||||||||